This is an overview of the book Rich

Dad's Cashflow Quadrant by Robert Kiyosaki

Kiyosaki's bio: Mr. Kiyosaki is a fourth generation Japanese American who was born in Hilo, Hawaii in 1947. He graduated for from the US Merchant Marine Academy and served as a helicopter pilot in the Vietnam war. Robert is an investor, an educator and founder of the Rich Dad company whose stated mission is to, “Elevate the financial well-being of humanity.”

Key point: You can not see money with your eyes, you can only see it with your brain. The way to strengthen your bank account is to strengthen your mind.

On the first page of the book you will find the following, “My rich dad used to say, 'You can never have true freedom without financial freedom.' He would go on to say, 'Freedom may be free, but it has a price.' This book is dedicated to those people willing to pay the price.”

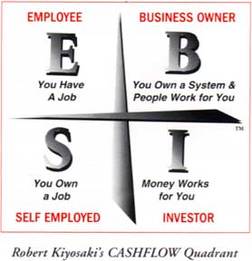

The Cashflow Quadrant is a diagram consisting of the four different types of people who make up the world of business. I must interject a little bit of opinion. This diagram is absolutely brilliant. It is a clear and simple way to understand the four ways in which money is made in America. Kiyosaki says that the people in each quadrant have a different set values which attracts them to that quadrant. He goes on to say that you can always tell the mindset, and values, a person has by the words they use.

Here's a copy of The Cashflow Quadrant. I'll quickly explain each quadrant.

E stands employee – This is your typical 9-5 occupation. These are people that are primarily interested in security. A person from this quadrant can be heard saying the following, “I'm looking for a safe, secure job with good benefits.”

S stands for self-employed, small business, or specialist – These people often say, ”If you want something done right, you gotta do it yourself.” This is where you will find the world's hardcore perfectionists.

Right side of the quadrant:

B stands for big business – These are the people that are primarily motivated by freedom. They say things like, “I'm looking for a great system and great people to work for me.” They are the ones that hire the E's and S's.

I stands for investor – This is the quadrant where true wealth is created. These people invest in the B's of the world. These people say, “I don't work hard for money, my money works hard for me.”

Robert's Rich Dad would warn him to beware of money's addictive power. People don't simply work at their job because of desire or habit. It's more like an addiction. The reason so few people successfully switch quadrants is because switching is akin to breaking that addiction. The effects of the withdrawals are just too powerful.

Here are a couple of important dates that Kiyosaki points out. These events have drastically affected the way money works in America. The first was in 1971. It was in 1971 when President Richard Nixon took us off the gold standard. This meant that the quantity of our money supply was no longer anchored to a quantity of gold. This turned our money into a fiat currency which the government can print at will. The result is, “Savers are losers.”

With the Federal Reserve printing lots of money we see inflation and a declining value to the dollar. For this reason, it is no longer a good strategy to simply save money. A much better idea is to invest your money and, to do that, you need education. Kiyosaki is not a big fan of mutual funds. He views them as very risky. Mutual funds are purchased from salespeople, in the S quadrant, not investors. Mutual funds are sanitized securities that operate by a strategy of diversification (Warren Buffett calls it de-worse-ification.) Buffett and Kiyosaki say the intelligent investor operates with concentration and focus.

A lot of people believe that investing is risky. But, as Kiyosaki is fond of repeating, “Investing is not risky. Being uneducated is risky.”

In actuality, your hand has already been called, and you might not even know it. It is very likely you will need to become an investor. The reason for this is a law Congress passed in 1974 called ERISA. You may not be familiar with the name but you're probably aware of the outcome. Before ERISA we had what are called defined benefit (DB) pension plans. DB plans pay retirees a guaranteed monthly income until the end of their days. After the passing of ERISA, we now have defined contribution (DC) pension plan, such as IRA's and 401(k)s. The pay-out of DC plans are dependent on the preceding pay-in.

What's more, this shift will cause people to be responsible for their own investments. This idea may sound innocent enough but, here's the problem. People will need to begin operating from the I quadrant. Unfortunately, most people do not currently possess the skill set of of an investor (remember how Kiyosaki said that's the problem with mutual funds?) In his book Prophecy, Robert talks about how this shift, from DB to DC pension plans, will result in the, "Biggest stock market crash in history." His predicted crash will result from unskilled, uneducated people operating as investors.

The previous two examples, 1971 and 1974, illustrate the changing landscape of the world of money. We can chose to put our heads in the sand, ignoring what is happening, and hope for the best. Or, we can get involved, participate in the coming changes, and take control of our lives.

The Tax Reform Act of 1986 eliminated most of the benefits that came with being in the S quadrant. And, the E quadrant is an even worst place to get rich. One of the main reasons are taxes. In 1943 the government began collecting taxes through payroll deductions (thank you Milton Friedman.) In this way, the government makes sure they get paid first. The E quadrant really gets hammered. Not only do they pay taxes first. They also have to pay the most taxes, as far as percentages go.

The path that Kiyosaki suggests, for financial freedom, is the following. If you are an E or an S, get yourself successful in the B quadrant. Then take your excessive cash flow and invest in the I quadrant.

The test of a big business is the following: Can you walk away from your business, for a year or more, and come back to find it as successful, or even more successful, than when you left? If you can honestly answer yes to that question, congratulations, you're a successful B!

Kiyosaki also says that the B stands for Bill, Buffett, and Branson. Meaning, people like Bill Gates, Warren Buffett, Oprah Winfrey, and Richard Branson are true B business owners. But, to create a Microsoft, Berkshire Hathaway, Harpo Productions or Vigin would take many millions of dollars, and lots of time. Two resources very few of us have. Luckily Kiyosaki offers an alternative, network marketing. After much research Robert has concluded that network marketing, as known as multi-level marketing, is the best way for most people to follow his suggested path to financial freedom.

Kiyosaki says, "To be successful in the B or I quadrant requires financial intelligence, systems intelligence, and emotional intelligence. These things cannot be learned in school." For financial intelligence one could (and should) study Mr. Kiyosaki. Robert says that one of the main reasons most people never get rich is because they can't gain mastery over their emotions. He says that most people are ruled by fear and greed, which keeps them stuck in the Rat Race. To help gain control over our emotions Kiyosaki suggests reading Emotional Intelligence by Daniel Goleman. I have written an overview of this book. So, if I haven't already, I will soon post it to this blog. In Cashflow Quadrant, Kiyosaki doesn't suggest a book to learn systems intelligence. However, please allow me the liberty of suggesting a book for you. It was written by the MIT professor of management, Peter Senge. The book is titled The Fifth Discipline. Like Goleman's book I have written an overview of Senge's book. And again, if I haven't posted it yet, I will soon.

Mr. Kiyosaki gives financial advice that is quite different from the majority of advisors. I'm talking about people like Dave Ramsey and Suze Orman. They're both into the old school way of investing, the orthodoxy. In the old school it's about saving and getting out of debt. This is probably the best strategy for the majority of Americans. But Robert takes a different approach. Kiyosaki's advice is summed when he says, "Live within your means and then increase your means." Translation, Robert doesn't believe in cutting out that Starbucks latte or whatever. Kiyosaki says he likes driving his Lamborghini and he isn't going to apologize.

The implications of Kiyosaki's Cashflow Quadrant range far and wide. I couldn't possibly explain them all in this short overview. If you'd like further information or clarification just get a hold me me. I'll end with a detailed Cashflow Quadrant:

What can you do with this information right now?

Very simply, embrace the cashflow quadrant. Do whatever it takes to understand and internalize the teachings of this book. You might even have to read the whole book. But, I can assure you it's worth it. Once you comprehend Kiyosaki's genius you will begin to see the world through a completely different lens. One of my favorite quotes comes from the French author Marcel Proust. He said, "The real voyage of discovery consists not in seeking new landscapes but in having new eyes." Remember, money is just an idea. So if you want more money, you need better ideas. Get to become a B business owner. According to Robert Kiyosaki and Donald Trump, the best option for most people, is to join a network marketing company. This way you can keep the job you have, while learning Rich Dad's lessons on the side. If you ask nicely, I might let you join me. :)